So you're dreaming about wandering the cobbled streets of Europe, soaking in the sun from a café in Sydney, or immersing yourself in the bustling energy of Tokyo—all while getting an education to remember. But before you pack your bags, there's the burning question that needs a solid answer: How much does it really cost to study abroad?

This dive into the numbers doesn't just think inside the box; it explores everything from tuition specifics to the cost of grabbing a latte at your new favorite corner café. As we journey through the world of international education, we'll highlight the unexpected expenses that might sneak up, and how scholarships could make your dream affordable. Consider this your essential roadmap to understanding, planning, and managing the finances so you can focus on the adventure awaiting you.

- Understanding Tuition and University Fees

- Cost of Living: Accommodation, Food, and Transportation

- Hidden Expenses: Visas, Insurance, and Miscellaneous

- Scholarships, Grants, and Financial Aid

- Budgeting Tips and Financial Planning for Students

Understanding Tuition and University Fees

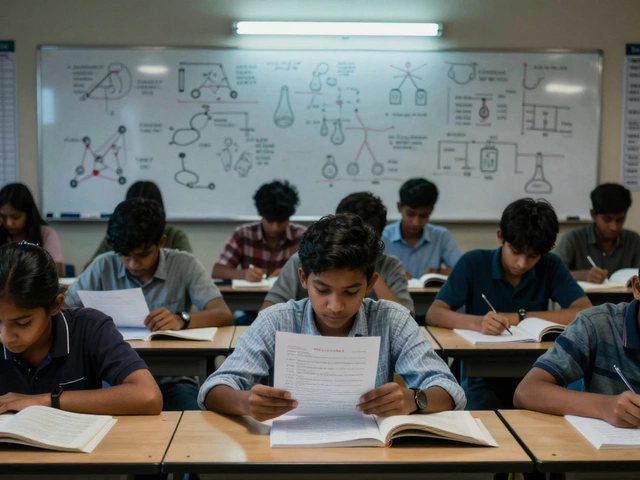

When it comes to studying internationally, one of the most significant financial considerations is undoubtedly the study abroad cost. Tuition fees vary widely across countries, sometimes even from one institution to another within the same country.

In the United States, for instance, private universities often charge significantly more than public ones. International students pursuing an undergraduate degree might expect to pay anywhere from $25,000 to $45,000 annually. Meanwhile, in the UK, fees can range from £10,000 to £38,000 depending on the course and university ranking.

Understanding Fee Structures

It's essential to understand that tuition isn't the only financial obligation. Many universities have registration fees, lab fees, resource access fees, and more. Breaking down these components helps in achieving a clearer picture.

- Application Fees: Before stepping into the academic world, you'll likely incur application fees, which can range from $50 to $100 per institution.

- Course Fees: These cover the academic instruction and assessment costs.

- Administrative Fees: Sometimes these are rolled into tuition but can be additional costs for facility usage, student services, etc.

- Program-specific Costs: Specialized programs such as art or engineering might demand extra fees for necessary materials or lab usage.

The Influence of Scholarships and Financial Aid

Scholarships and financial aid play a crucial role in offsetting the financial burden. Many universities offer merit-based scholarships specifically for international education expenses, and some are surprisingly generous.

An example is the Chevening Scholarship in the UK, which covers all expenses including tuition, living, and travel. Australia offers destination-specific scholarships like the Endeavour Postgraduate Leadership Awards. It's worth scouring global offerings to find a fit for your plans.

Comparative Tuition Costs by Region

To further illustrate the variance, let's consider a snapshot across different regions:

| Region | Average Annual Tuition |

|---|---|

| Western Europe | €6,000 - €25,000 |

| Eastern Europe | €2,000 - €8,000 |

| East Asia | $5,000 - $15,000 |

| Australia | AUD 20,000 - AUD 45,000 |

While understanding these costs is a complex task, investing time in meticulous research can open pathways to manageable budgeting. Armed with this knowledge, you can start to piece together the jigsaw of your international education journey, making your dream of studying overseas a financially feasible reality.

Cost of Living: Accommodation, Food, and Transportation

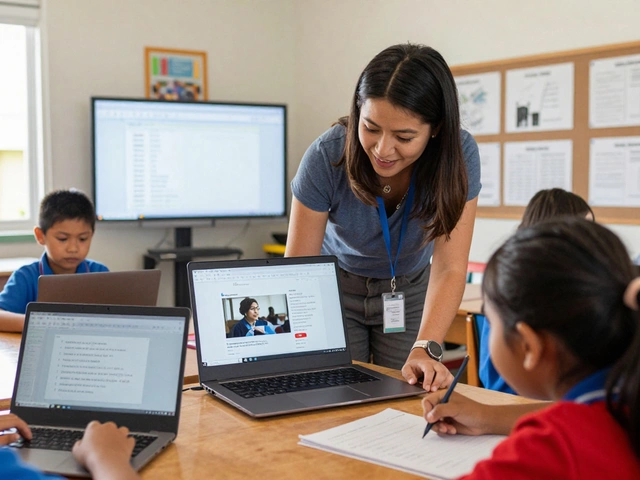

When embarking on the journey to study abroad, understanding the cost of living is just as crucial as calculating tuition fees. Accommodation, food, and transportation can significantly vary depending on your chosen destination, and it's essential to research and budget accordingly.

Accommodation: From Dormitory to Apartment Living

Your housing choices will largely depend on personal preference and budget constraints. University dormitories or student housing are often the most affordable options, sometimes included in tuition fees, or available at a discounted rate. These provide a great way to make friends and immerse yourself in campus life.

If you prefer more independence, renting a private apartment or sharing accommodation with fellow students can offer valuable life experiences. Cities like London, Sydney, and New York are notorious for higher rental costs, averaging between $1,500–$3,000 per month. In contrast, places like Berlin or Lisbon might offer more affordable options, typically ranging from $500–$1,200.

Food: Grocery Stores vs. Dining Out

Food expenses can be managed through smart choices. Cooking at home with groceries from local supermarkets is generally cheaper and healthier than dining out. On average, students might spend anywhere from $200 to $600 a month on groceries, depending on location and dietary preferences.

In contrast, habitual dining out or frequenting trendy cafés can quickly add up. A meal for two at a mid-range restaurant in Paris might set you back about €50, while in Bangkok, you'd spend approximately 1,000 THB for a similar experience.

Transportation: Navigating Your New City

Transportation costs are another critical component of the studying overseas budget. Many cities have well-developed public transport systems that offer student discounts, making getting around both practical and affordable. For instance, a monthly metro pass in cities like Tokyo or Moscow could range between $50 and $100.

Biking is not only environmentally friendly but also a cost-effective option in bike-friendly cities like Amsterdam or Copenhagen. However, owning a car generally incurs higher expenses given fuel, insurance, and maintenance costs.

Cost of Living Comparison Table

| City | Average Monthly Rent | Grocery Costs | Public Transport Pass |

|---|---|---|---|

| London | $2,200 | $400 | $150 |

| Berlin | $1,000 | $300 | $90 |

| Tokyo | $1,500 | $450 | $70 |

Ultimately, a smart blend of financial planning and research tailored to your destination can help you manage the international education expenses without compromising on the rich experiences studying abroad promises.

Hidden Expenses: Visas, Insurance, and Miscellaneous

While tuition fees and housing often top the financial concerns list, hidden expenses can quickly inflate your study abroad cost. These costs, often underestimated, include visas, insurance, and a range of miscellaneous fees that can sneak up on international students.

Visas

Getting a student visa is a significant initial expense. Depending on the country, visa fees can range from $50 to over $500. For instance, a F-1 visa for the United States costs approximately $350 with an additional $160 application fee, while the Schengen visa for most of Europe hovers around €60. These fees are just the start, as some countries require proof of funds or financial solvency, which might involve opening a local bank account or purchasing a bonds certificate.

Insurance

Health insurance is often mandatory for international students and costs can vary widely. Coverage can range from basic to comprehensive, with premiums costing anywhere from $500 to $2,000 per year. In the UK, the International Health Surcharge (IHS) is a per-year fee added to your visa application, offering you access to the National Health Service. In countries like Australia, Overseas Student Health Cover (OSHC) is a must-have and must be paid before arrival, ranging generally between AUD$400 to AUD$600 annually.

Miscellaneous Expenditures

This category is the trickiest to predict yet pivotal in planning your overseas education budget. Miscellaneous costs can be anything from textbooks averaging $200 per semester to technology needs like laptops and software. Additional expenses could include orientation fees, student union fees, or compulsory excursions. Don’t forget personal expenses: phone cards, public transport, and social activities which can easily add another $100-$300 monthly.

Unexpected Fees

- Migration processes: Some countries might require you to register with the local government, incurring additional charges.

- Banking and Currency: Currency exchange fluctuations and international bank transfer fees can affect your budget.

- Legal Documentation: Notarizations and translations of certain documents could be necessary, potentially costing an additional $100 or more.

Being forewarned about these hidden expenses can save you from unpleasant surprises. It's wise to build a financial buffer that accounts for these additional costs, ensuring you can focus more on your education and less on financial stress during your international education.

Scholarships, Grants, and Financial Aid

For aspiring international students, scholarships, grants, and financial aid can be game-changers, transforming the seemingly daunting expenses of studying overseas into manageable challenges. Understanding these available resources is crucial in turning aspirations into attainable plans.

Scholarships: Merit-Based Opportunities

Scholarships are often awarded based on academic, athletic, or artistic merit. Prestigious scholarships like the Fulbright Program in the United States or the Chevening Scholarships in the UK support thousands of international students each year. These awards cover a range of costs including tuition and even living expenses, depending on their specific guidelines.

When applying for scholarships, ensure you understand the eligibility criteria and deadlines. Tip: Start your application process early and tailor each application to highlight relevant achievements specific to the scholarship's focus.

Grants: Need-Based Assistance

Unlike scholarships, grants are typically awarded based on financial need. They are not required to be paid back, which makes them highly beneficial for students concerned about accumulating debt. Organizations like the Institute of International Education offer a variety of grants for specific purposes, such as the Benjamin A. Gilman International Scholarship, which aids U.S. students of limited means.

Financial Aid: Loans and Work-Study Programs

Financial aid often includes a combination of loans and work-study opportunities. Loans, while they require repayment, can still make education abroad feasible by providing upfront financing. Many countries, such as the United States, offer federal loans to citizens or permanent residents studying overseas.

Beyond loans, work-study programs allow students to offset living expenses through part-time employment, typically on or near campus. This scheme not only supports students financially but also offers the invaluable experience of blending into the local culture and job market.

Key Considerations

- Research available scholarships and grants well in advance and prioritize applications by deadline and eligibility.

- Consider both your home country and host country for potential financial aid opportunities.

- Be mindful of the terms of financial aid offers, particularly loans, understanding the total repayment expected after graduation.

Navigating the Application Process

Applying for scholarships, grants, and financial aid is a process demanding diligence and attention to detail. Here are a few steps to guide you through:

- Gather a list of potential scholarships and grants relevant to your field and country of study.

- Prepare necessary documentation, including transcripts, letters of recommendation, and personal statements.

- Adhere to deadlines and follow up on submitted applications to ensure they are complete and well-received.

Embracing these financial resources can significantly ease the cost burden of studying abroad, turning a dream into reality. By smartly leveraging scholarships, grants, and financial aid, students can immerse themselves in an enriching educational experience without being overburdened by financial constraints.

Budgeting Tips and Financial Planning for Students

Studying abroad can strain your finances if approached without a well-crafted plan. Embarking on this adventure requires attention to detail and strategic thinking to cater to tuition, living expenses, and those inevitable spontaneous spending moments. Let's delve into some effective budgeting techniques and financial planning strategies that ensure you can balance your checkbook while enjoying your international escapade.

Set a Realistic Budget

The first step in mastering financial responsibilities abroad is to establish a realistic budget. This means evaluating not only big expenses like tuition and accommodation but also smaller, recurring costs such as groceries and transport. Be sure to research the cost of living in your chosen city as these vary significantly across the world—from rent in expensive locales like London to dining out in more affordable places such as Lisbon.

Track Your Expenses

Consistently tracking your expenses can illuminate spending patterns and flag areas where you may need to cut back. Mobile apps like Mint or YNAB (You Need a Budget) can streamline this process, offering comprehensive views of your financial health at a glance. Regular reviews can prevent unpleasant surprises and help keep your spending on track.

Utilize Student Discounts

Taking advantage of your student status can lead to significant savings. Many countries offer discounts for students on transportation, dining, and entertainment. The International Student Identity Card (ISIC) is a worthwhile investment, unlocking numerous savings worldwide.

"Financial planning is not just about creating a budget. It's about living your intended lifestyle without derailing your future financial goals." - David Ramsey, Financial Author

Emergency Fund

It is prudent to have an emergency fund, especially when living abroad. This is a set amount of money reserved for unforeseen circumstances, such as medical emergencies or unexpected travel fares. As a rule of thumb, having enough to cover three months of living expenses ensures you're prepared for any curveballs thrown your way.

Explore Part-Time Work

If your student visa allows it, consider undertaking part-time work to cushion your finances. Jobs on campus or in local businesses not only earn you extra cash but also enhance your linguistic and cultural immersion.

Financial Aid and Scholarships

Don't forget to leverage the myriad of scholarships and grants specifically aimed at international students. Websites like Fastweb or the government's study portals often list opportunities which could significantly offset costs.

| Country | Average Monthly Cost of Living (USD) |

|---|---|

| United States | 1,500 - 2,400 |

| United Kingdom | 1,300 - 1,800 |

| Australia | 1,400 - 2,200 |

| Germany | 900 - 1,300 |

| Spain | 800 - 1,200 |

Ultimately, the key to a stress-free financial experience abroad is ingrained in methodical planning, regular tracking, and proactive adaptation. With these strategies, students can concentrate on savoring their international education rather than fretting over finances.